A new report from the Congressional Research Service (CRS) – Congress’s nonpartisan research arm – touched a nerve among free-market ideologues, who reacted to the wonky policy brief by accusing CRS of partisanship and calling their analysis into question. But politicians from both parties, as well as these same ideologues, often cite CRS data and reports in their own research – so what gives?

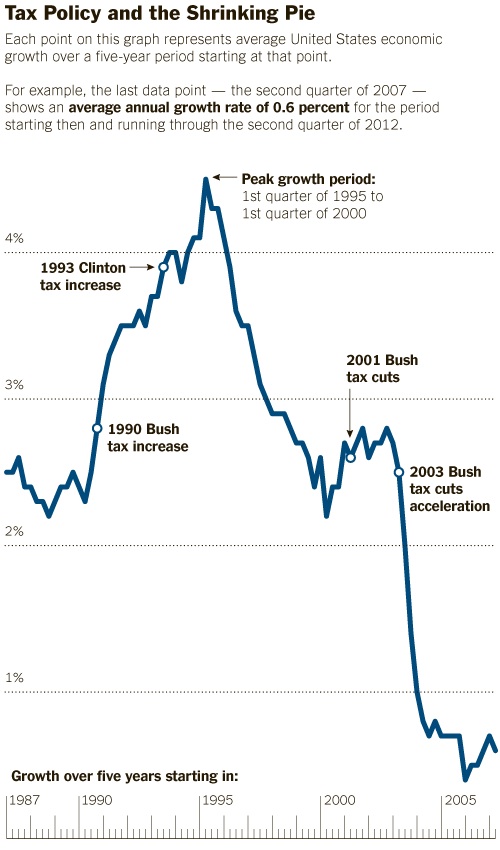

The findings of the CRS report are neither surprising nor groundbreaking. Simply put, their analysis finds no evidence to substantiate a relationship between tax cuts and economic growth (either positive or negative), although it does find that lowering the top tax rate is associated with the increasing concentration of income at the top of the income distribution. Those two outcomes are no-brainers: trickle-down economics has already been debunked, and cutting taxes for rich people will, of course, increase their incomes.

But perhaps the hand-wringing among these ideologues can be explained simply by looking at the question posed by the authors:

Advocates of lower tax rates argue that reduced rates would increase economic growth, increase saving and investment, and boost productivity (increase the economic pie)… This report attempts to clarify whether or not there is an association between the tax rates of the highest income taxpayers and economic growth.

The CRS report was seeking conclusive evidence to establish a link between tax cuts and economic growth, but found none. When the findings were published, free-market conservatives saw it as an attack on the crown jewel of their ideological position and responded accordingly. By even asking the question, the CRS report inadvertently challenged a basic tenet of these ideologues: that tax cuts unequivocally lead to economic growth.

Instead of tax cuts, a more proven form of economic stimulus has been government investment in research and development, which has lead to breakthoughs like the internet, telecommunications, and medical advances – providing millions of jobs and boosting the American economy. Sure the CRS report debunks the link between tax cuts and economic growth, but it’s also a good reminder that tax policy and economic growth can be mutually exclusive.

More To Read

April 17, 2024

2023-24 Impact and Gratitude Report

Reflecting on a year of progress and transition at EOI

April 12, 2024

Welcoming our New Executive Director, Rian Watt!

EOI is excited to begin its next chapter under new leadership

April 4, 2024

Is There a Valid Argument Against Cost-Free College in Washington?

Cost-free college is a meaningful investment that would change lives. What's stopping Washington from making it happen?