At a time when people are increasingly worried about retirement – both their own and the retirement of their parents and grandparents – a new poll shows the vast majority of Americans support higher taxes to increase Social Security benefits.

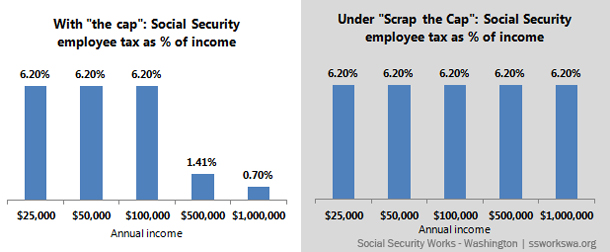

As we (and others) have been saying for years, Social Security’s problem is small and very manageable. If all Americans paid the same Social Security tax rate, the system would be financially sound for generations to come. But this year, Social Security taxes will only be levied on the first $113,700 of earnings – that’s “the cap” – and people earning over it don’t pay in on those earnings. Scrapping the cap would ensure all Americans contribute their fair share to Social Security, and preserve it for future generations.

Now, it seems the majority of Americans agree that higher taxes – and scrapping the cap – are the best way to shore up Social Security.

A poll commissioned by the National Academy of Social Insurance (NASI) asked people about a menu of options, from raising to retirement age, to cutting benefits, to increasing taxes. Here is the package of reforms supported by 71% of respondents:

- Gradually eliminate the cap on earnings ($113,700 in 2013).

- Gradually raise the payroll tax rate on both employers and workers from 6.2% to 7.2%.

- Bolster a special minimum benefit intended to keep very low-income workers out of poverty.

- Set Social Security’s annual inflation increase, using a measure of consumer prices that accurately reflects the higher prices older people pay for healthcare – effectively, the opposite of a chained CPI.

- Keep Social Security’s full retirement age at 67, and do not means test the program.

Some find it surprising that so many people are willing to sacrifice a bit more to ensure Social Security will be there for their parents, children, and themselves – but perhaps they shouldn’t. Just 14% of Americans report having enough money to live comfortably in retirement, and barely 2 in 5 private-sector workers between 25 and 64 have a employer-sponsored retirement plan of any sort.

Of course, not ALL Americans love Social Security. Remember that the Business Roundtable, representing 200 of America’s most influential and wealthy CEOs, proposed a plan to raise the retirement age to 70 and cut benefits via the chained CPI.

Perhaps this poll will be the impetus needed to swing politicians and journalists away from their fear-mongering about Social Security.

More To Read

April 17, 2024

2023-24 Impact and Gratitude Report

Reflecting on a year of progress and transition at EOI

April 12, 2024

Welcoming our New Executive Director, Rian Watt!

EOI is excited to begin its next chapter under new leadership

April 4, 2024

Is There a Valid Argument Against Cost-Free College in Washington?

Cost-free college is a meaningful investment that would change lives. What's stopping Washington from making it happen?