For nearly 300,000 people working at or near Washington’s minimum wage, the 15-cent cost-of-living adjustment (to $9.19 per hour) scheduled for January 1st, 2013 will help their paychecks keep up with the cost of living – but it’s far short of what the vast majority need to make ends meet.

In 2013, a full-time minimum wage worker in Washington will earn $19,115 per year. A single adult can get by on that in many rural areas, but for most workers – including anyone with a family – the minimum wage isn’t enough to cover basic daily expenses. (County-by-county breakdown below.)

Still, experts say the increase will help stimulate the state’s economy by putting more money in consumers’ pockets, and improve economic prospects for future job-seekers. “Adjusting the minimum wage to keep up with inflation helps keep workers out of poverty – and this money will also help sustain growth, since these workers are likely to quickly spend their pay increase”, says Dean Baker, an economist with the Center for Economic and Policy Research in Washington, DC.

It will also improve economic prospects for future job-seekers, according to a job market analysis by Marilyn Watkins, of the Economic Opportunity Institute. Of the twenty occupations projected by the Washington State Employment Security Department to have the greatest increases in employment numbers between 2008 and 2018, Watkins found more than half are low-wage positions.

Watkins says Washington’s minimum wage increase will help ensure those jobs measure up. “A strong minimum wage is especially important for Washington’s working people, families and economy, since low-wage positions are projected to add significantly more jobs than high-wage occupations in the coming years,” she says.

Washington first set the bar in 1998, with 66% of voters approving an initiative that raised the state’s minimum wage then pegged it inflation. It is one of 10 states that adjust the minimum wage based on inflation, including: Arizona, Colorado, Florida, Missouri, Montana, Nevada, Ohio, Oregon, and Vermont.

Some cities have also established minimum wages: In 2012, San Francisco and Santa Fe had city-wide minimum wages of $10.24 and $10.29, respectively. New York City requires any private development project directly accepting $1 million or more in taxpayer subsidies to pay employees of $10/hour with supplemental health benefits or $11.50/hour without benefits.

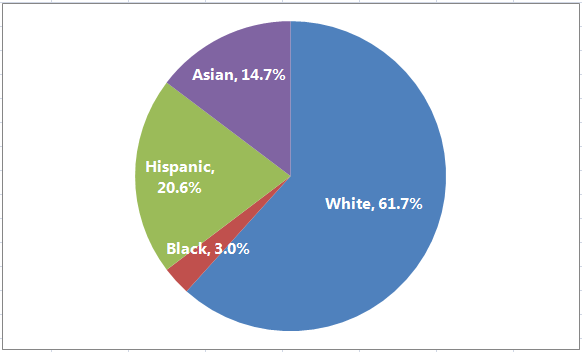

Update: 9/28/12 1:12 p.m. corrected race/ethnicity data.

Update: 9/28/11 2:34 p.m. corrected county-by-county minimum wage “over/under” data for families with 2 adults.

More To Read

April 17, 2024

2023-24 Impact and Gratitude Report

Reflecting on a year of progress and transition at EOI

April 12, 2024

Welcoming our New Executive Director, Rian Watt!

EOI is excited to begin its next chapter under new leadership

April 4, 2024

Is There a Valid Argument Against Cost-Free College in Washington?

Cost-free college is a meaningful investment that would change lives. What's stopping Washington from making it happen?