The land of higher education teeters on the brink, as a winter of student debt threatens to sweep down upon it from a white wall of loans. Yet hope endures, for a “Stark” contrast has emerged: Pay It Forward.

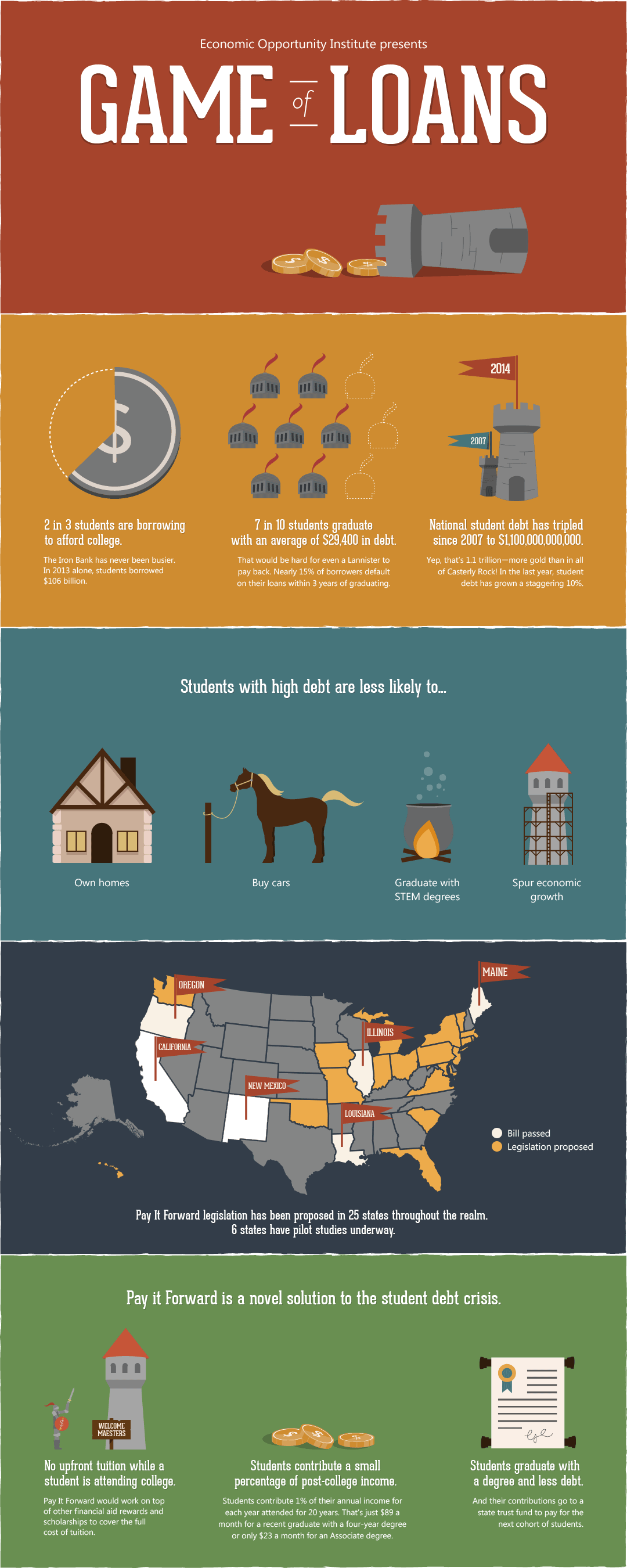

Today, 7 in 10 students are graduating with an average $29,400 in debt, making them less likely to own homes, buy cars, graduate with a STEM degree, and spur economic growth.

EOI’s Pay It Forward plan offers no upfront tuition while attending college – instead, students contribute a small percentage of post-college income, so they graduate with a degree and less debt.

It would work on top of other financial aid rewards and scholarships to cover the full cost of tuition. Students contribute 1% of their annual income for each year of college attendance, for 20 years. That’s just $89 a month for an recent graduate with a Bachelor’s degree, or $23 a month for someone with an Associate degree. And the contributions go to a state trust fund to pay for the next cohort of students.

More To Read

May 2, 2024

Baby Bonds: A Step Toward Racial and Economic Equity

The Washington Future Fund would bring this innovative, anti-racist policy to the Evergreen State

May 1, 2024

Laws Targeting LGBTQ Youth Aren’t Just Bad for Kids – They’re Bad For The Economy

The harm done by anti-LGBTQ laws expands so much further than queer children and teens

April 26, 2024

What is WA Cares and Why Does It Matter for Washingtonians?

We need to defend this important policy from billionaires looking to save a buck