On Friday, KUOW’s Ross Reynolds discussed the potential expiration of the Bush tax cuts for income over $250,000 per year. He took calls from small several business owners, venture capitalist Nick Hanauer, and EOI Policy Director Dr. Marilyn Watkins (at 15:10).

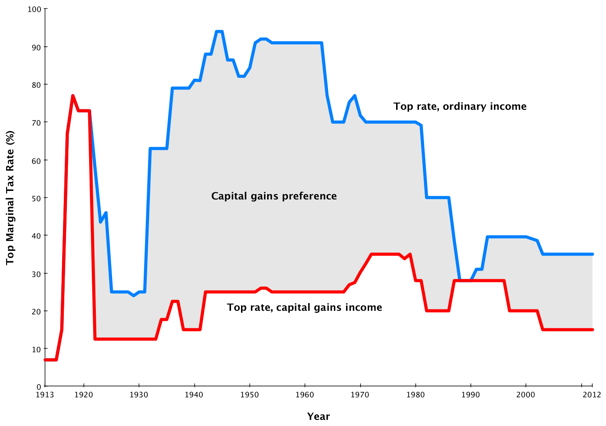

The top rate, currently 35%, applies to income earned over $388,000. Repealing the Bush tax cuts for high earners would restore a rate of 39.6% for income above that level – the same top rate that existed during the Clinton years – to income earned over $250,000. And remember, that top rate only applies to income earned over $250,000.

Watkins pointed out that our economy boomed during the Clinton years when the top tax rate was higher, with record job growth and expansion in nearly every sector of the economy. “Compared to the entire period since the Bush tax cuts went into place, we’ve seen – even in the so-called good part of the economy in the Bush years – the economy wasn’t doing that well. The key thing that determines business investment… is consumer demand.”

Venture capitalist Nick Hanuer, who supports letting the Bush taxes for the rich expire, also had some thoughts about its potential impact on the economy:

The canard that higher taxes on the rich will reduce economic growth is one of the biggest lies ever told to the American public. And here’s how you know that’s true. If lower taxes on the rich or more income from the rich was going to create jobs, then today, given how much those tax rates have gone down over the last 20 years, we would be drowning in jobs.

Listen to the full segment here.

More To Read

April 17, 2024

2023-24 Impact and Gratitude Report

Reflecting on a year of progress and transition at EOI

April 12, 2024

Welcoming our New Executive Director, Rian Watt!

EOI is excited to begin its next chapter under new leadership

April 4, 2024

Is There a Valid Argument Against Cost-Free College in Washington?

Cost-free college is a meaningful investment that would change lives. What's stopping Washington from making it happen?