The Institute on Taxation and Economic Policy (ITEP) has concluded Washington State has the most regressive tax system in the country. How will Initiative 1098 help restore balance?

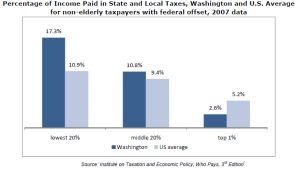

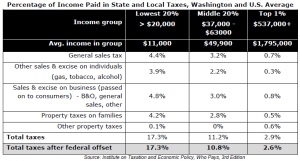

Background: What’s a regressive tax? A regressive tax is one that takes a larger percentage of the income of low-income people than of high-income people. According to ITEP’s most recent report, published in 2009 based on 2007 data, the 20% with the lowest incomes in Washington pay 17.3% of their income in state and local taxes, compared to 10.8% for the middle group and 2.6% for those in the top 1%.

What’s included in ITEP’s calculations of percentage of income paid in state/local taxes? In addition to general sales tax, people pay taxes on gas, tobacco, alcohol, and utilities. Individuals also pay many taxes indirectly that are also included in the total. Even if someone rents, landlords include the cost of property taxes in the rent, and businesses pass on the part of the cost of their taxes in prices.

Why are the rates so low for the top income group? Taxes based on consumption almost inevitably fall most heavily on low and moderate income people. Even though the wealthy buy more goods at higher prices than low income people do, there is simply a limit to how much a household can consume. High income people also spend much more on services that are generally not subject to sales tax. Low and moderate income people routinely spend almost all of their income, while the wealthy routinely do not.

How can the lowest income group possibly pay over 17%? In addition to the taxes that consumers pay directly, including general sales tax and taxes on gasoline, cigarettes, and alcohol, The Institute on Taxation and Economic Policy (ITEP) also calculates the taxes people pay indirectly in higher prices that are passed on directly to them.

Landlords pass on the cost of property taxes to renters. Businesses pass on their costs to consumers, including the sales, gasoline, and property taxes they pay. ITEP, along with most economists, treat the B&O tax on gross receipts as a sales tax. The Federation of Tax Administrators, representing state revenue departments across the country, also treats gross receipts taxes as a sales tax.

How did ITEP come up with these numbers? ITEP has developed a complex model that allows it to compare the tax systems of all of the states. Their model of federal taxes produces very similar results to the models used by the U.S. Treasury Department and Congressional Budget Office.

Read the entire fact sheet: Initiative 1098: Fixing the most regressive tax system in the country

Looking for more information about Initiative 1098? Visit the Economic Opportunity Institute website.

More To Read

April 17, 2024

2023-24 Impact and Gratitude Report

Reflecting on a year of progress and transition at EOI

April 12, 2024

Welcoming our New Executive Director, Rian Watt!

EOI is excited to begin its next chapter under new leadership

April 4, 2024

Is There a Valid Argument Against Cost-Free College in Washington?

Cost-free college is a meaningful investment that would change lives. What's stopping Washington from making it happen?