It’s simple math: More money for workers means a stronger economy – period.

What happens when we support the lowest-paid workers and families among us? Let us count the ways.

With increased pay, families are more able to put food on the table, parents can pay for childcare so they can go to work, and workers across the board rely less on public assistance like food stamps. As I explained to my 12-year old niece last night, the benefits of increasing the minimum wage are felt by more than just those workers that get the boost in their pocket books. Not only do those families benefit (especially children of single parents, who are often single moms), but our nation as a whole stands to gain from increased consumer spending and greater business activity.

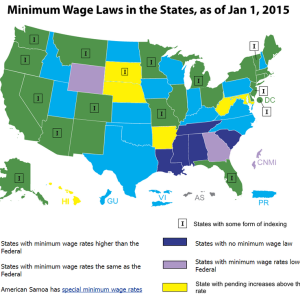

The federal minimum wage is currently $7.25 — an unlivable wage in every sense of the word. Sadly, for now whether you can make ends meet earning minimum wage (even while working full time) is determined by what state you live in — which is why Congress needs to follow the example of numerous states and localities around the country by 1) raising the minimum wage and 2) indexing it to inflation, so workers’ purchasing power doesn’t erode over time.

Many states are done waiting for the federal government to raise the minimum wage. Led by Washington state, twenty-two states plus Washington D.C. will raise their minimum wages in 2015, resulting in pay increases for over 4.9 million workers. Some of these states, such as Florida and our Oregonian neighbors to the south, will only see minor inflation adjustments (the lowest at a mere 5 cents). These small increases impact the 5-7% lowest paid workers among us who earn minimum wage or slightly above. Other states have legislated more sizable increases; Minnesotans will see $1.00 increase, which will result in a pay increase for almost 20% of wage earners in that state.

Rising Income Inequality

During times when we are seeing growing income inequality, with the richest collecting record profits of unearned income, and the poorest struggling to afford adequate food and shelter, we have a moral obligation (not to mention self-interest, for even the richest 1%) to ensure all working people and their children can care for themselves and their families.

According to researchers at the Economic Policy Institute, the top 1% is recovering from the Great Recession, but the income of the bottom 99% has actually decreased during what has been called, perhaps misleadingly, the ‘recovery.’

Many people know income inequality has grown — but less well-understood is the fact that the overall distribution of wealth is even more out-of-kilter, with the bottom 99% having suffered huge losses. (Side note: income and wealth are not the same — and it matters. Income is the money we bring in during a certain period, often in the form of a paycheck; by contrast, wealth is the value of capital and assets, such as investments.)

It comes as no surprise that wealth disparity has grown, particularly along racial lines, since the Great Recession. According to the Pew Research Center, White wealth has grown much faster, compared to Black and Latino households. In 2013, the median wealth of White households was 13 times the median wealth of Black households and 10 times the median wealth of Latino households. None of us (except the top 1%) are doing very well, but families of color are faring even worse.

A few voices from among the top 1% are calling for income inequality to be addressed, perhaps most notably by local venture capitalist and billionaire Nick Hanauer in “The Pitchforks are Coming for us Plutocrats” wherein he memorably warns his fellow wealthy compatriots: “For all of us who live in our gated bubble worlds: Wake up, people. It won’t last. I see pitchforks in our future.”

Washington State

So where does the Evergreen State fall in all of this minimum wage talk? Beginning tomorrow, Washington’s minimum wage will go up 15 cents an hour to keep up with the cost of inflation, leaving us at $9.47.

While it’s more than the federal minimum wage, it’s still not enough. New data from the Workforce Development Council of Seattle-King County illustrates just how much workers across the state need to earn in order to meet their basic needs. In every county, our current minimum wage falls short. For example, in Seattle, the hourly wage needed to make ends meet for one adult, one preschooler and one school-age child is $26.68. In Spokane, the wage for that same family would be $22.75 per hour, more than double the state’s current minimum wage.

Nearly 1 in 6 Washingtonians (14% of our population) lived below the poverty line in 2013, according to Census Bureau data. A disproportionate number of those living under the poverty line are African-Americans (26.7% of whom are under the poverty line, compared to only 12.5% of Whites), Latinos, American Indians and women of all races.

Washington state was a pioneer in 1998, when our voters overwhelmingly endorsed adding an annual cost of living adjustment to our state minimum wage. Last year, Washington state Representative Jessyn Ferrell introduced legislation to raise the state minimum wage to $12 over several years. We will see a similar bill this coming legislative session. For the sake of us all, it better pass this time. Because, as local racial and economic justice activist, Lauren Jacobson Spokane says, “the only way I can maintain my humanity is to work toward a world in which all of our humanity is recognized.”

The truth is, we can’t afford not to.

By Sam Hatzenbeler, MPHc

More To Read

April 17, 2024

2023-24 Impact and Gratitude Report

Reflecting on a year of progress and transition at EOI

April 12, 2024

Welcoming our New Executive Director, Rian Watt!

EOI is excited to begin its next chapter under new leadership

April 4, 2024

Is There a Valid Argument Against Cost-Free College in Washington?

Cost-free college is a meaningful investment that would change lives. What's stopping Washington from making it happen?