Washington’s broken tax system is taking a huge toll on our students and families – and endangering our democracy and economy to boot. It doesn’t have to be this way.

Two members of the University of Washington Board of Regents are sounding the alarm bell:

The cost of educating a student at the University of Washington is about $400 less today, in inflation adjusted dollars, than it was 20 years ago. As executives and directors of large business and philanthropic organizations in Washington state, our board members can attest that this could not have happened without a strong commitment to efficiency and cost control.

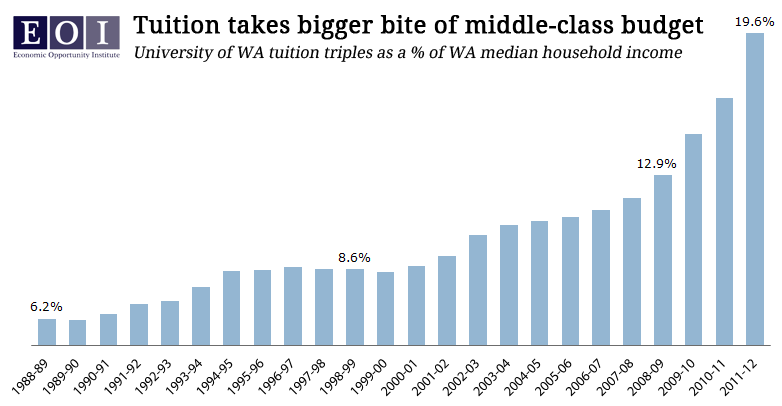

The next time anyone questions why public university tuition is rising faster than inflation, remember this: Twenty years ago, the state government paid 80 percent of the cost of a student’s education and a student paid 20 percent. Today, the state pays 30 percent of the cost, and the student pays 70 percent. The state has systematically disinvested in our children’s future, and we view this trend with disappointment and alarm. [Seattle Times]

Many of Washington’s elected leaders themselves benefited from better public funding of our state’s colleges and universities. The question is, how are they going to make that same opportunity available to today’s high school students?

More student aid (i.e. loans) are not the answer. The “high-tuition/high-aid” model in vogue at many universities – including the University of Washington – is actually a step backward in terms of access and affordability for all but the wealthiest of students.

So what can we do? Part of the answer includes eliminating the crushing loans that today’s students have to shoulder, through a model like Pay It Forward:

[It’s] an open opportunity for any graduating senior — limited by only their own academic performance — to attend their local community college or a state public university, tuition-free. In exchange, a legal quid pro quo: the student contributes 1.5 percent of their income, if they attended community college, or 4 percent if they attended a university, for 25 years.

Pay It Forward makes it easier to afford school by pro-rating the costs over a longer time frame, and is a better value for the public because it eliminates middlemen financiers and bankers from the equation. (They’ll be fine – they can still make loans to college grads for new cars, businesses, homes and the like.)

But there’s still the matter of the public obligation to support higher education, which is politically trickier, but no less necessary. Two good places our legislators can look for that revenue are: ending tax expenditures (closing loopholes, scrutinizing giveaways, etc.) and broadening the sales tax base to include (now tax-free) services.

Taking proactive steps like these now with help limit the economic damage of Washington’s current higher ed financing model, and set our state on a path to a deeper and more robust economic recovery in the years ahead.

More To Read

April 17, 2024

2023-24 Impact and Gratitude Report

Reflecting on a year of progress and transition at EOI

April 12, 2024

Welcoming our New Executive Director, Rian Watt!

EOI is excited to begin its next chapter under new leadership

April 4, 2024

Is There a Valid Argument Against Cost-Free College in Washington?

Cost-free college is a meaningful investment that would change lives. What's stopping Washington from making it happen?